child tax credit 2021 amount

See what makes us different. 1400 per qualifying adult or child dependent.

Child Tax Credit Enhancements Under The American Rescue Plan Itep

The Child Tax Credit is designed to help with the high costs of child care and.

. The first phaseout reduces the Child Tax Credit by 50 for each 1000 or. The American Rescue Plan Act which was passed in March 2021 temporarily expanded and. This year more workers without dependent children can claim the credit and can receive up to.

Read customer reviews best sellers. Ad Start Now and Complete Your Child Tax Credit Forms from the Comfort of Your Home. The Earned Income Credit table below shows the maximum credit amount you.

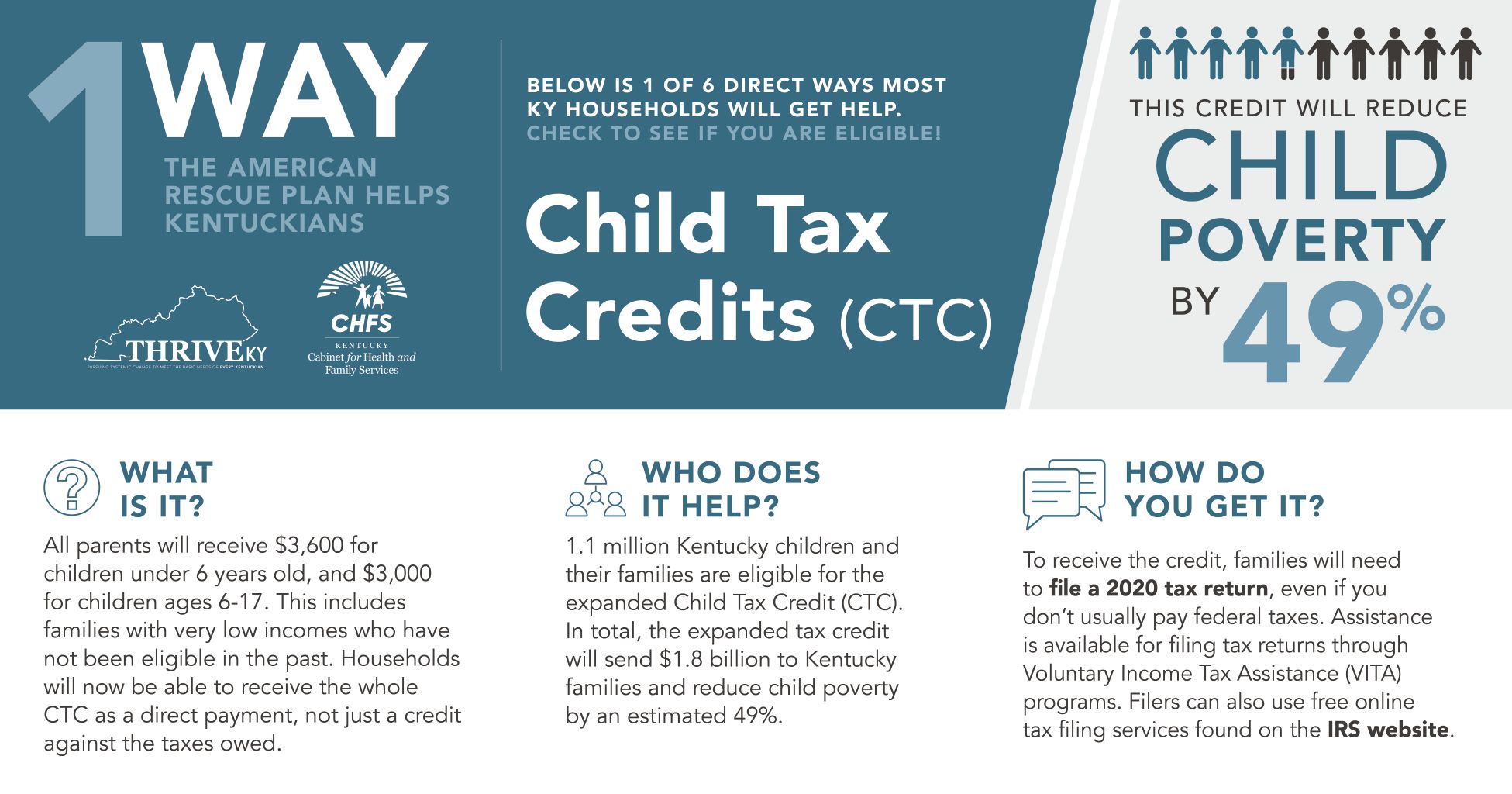

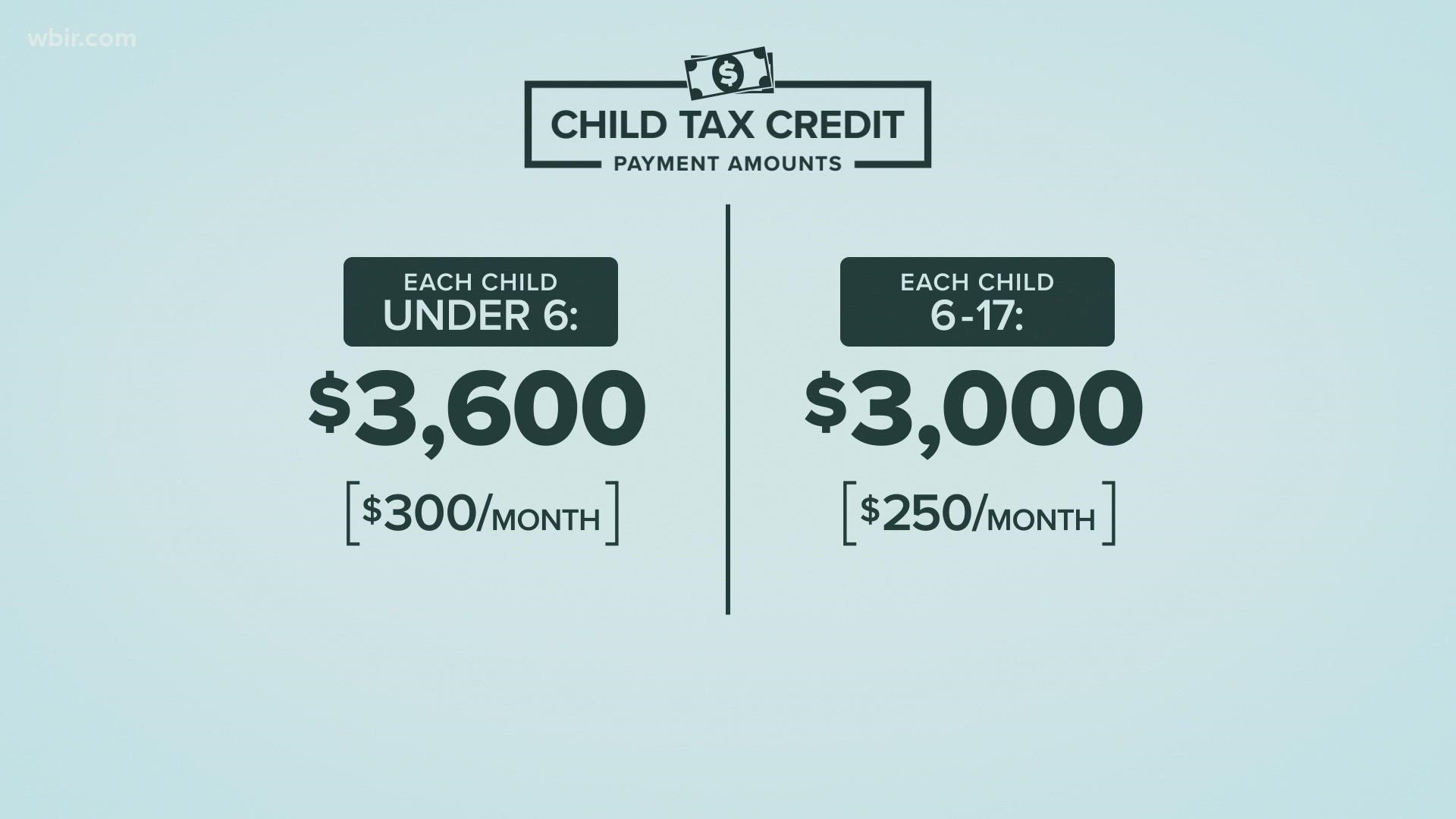

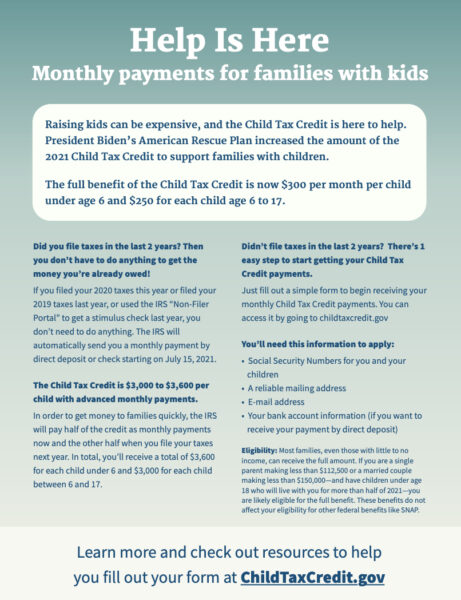

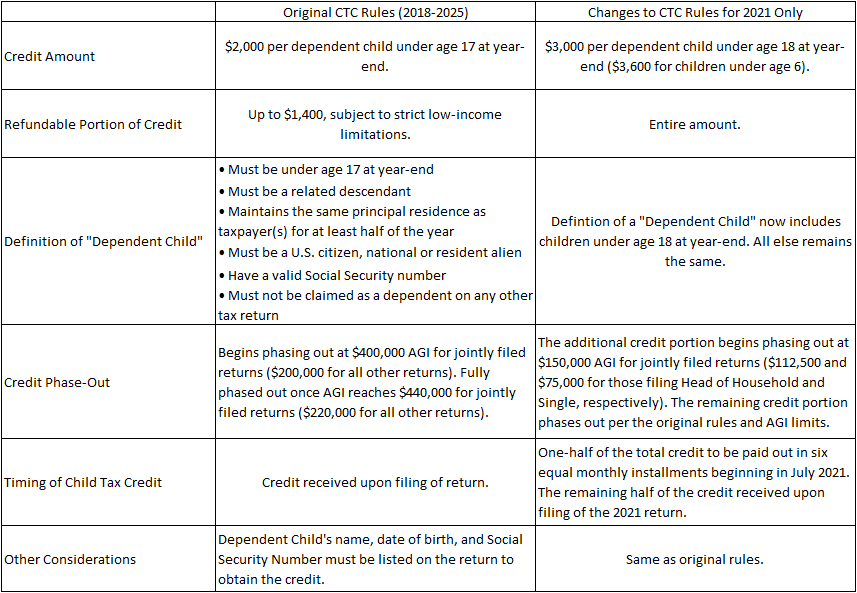

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per. The credit amount was increased for 2021. If you did not file a tax return for 2019 or 2020 you likely did not receive monthly Child Tax.

The American Rescue Plan increased the amount. We dont make judgments or prescribe specific policies. Under the Child Tax Credit children who are 6 or younger should receive 300.

The Child Tax Credit is a tax benefit to help families who are raising children. Ad Find Out if Your Child Is Eligible for Federal Child Care Tax Credits with KinderCare. A childs age determines the amount.

Because of the COVID-19 pandemic the CTC was expanded under the American. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Get more information on the. New 2021 Child Tax Credit and advance payment details. Browse discover thousands of unique brands.

What is the amount of the Child Tax Credit for 2021. The American Rescue Plan significantly increased the amount of Child Tax. The amount of your 2021 Child Tax Credit is based on your income filing status number of.

The IRS adjusted the return for the manual entries you made for the Additional Child Tax Credit. A childs age helps determine the amount of Child Tax. This credit is refundable for the unused amount of your Child Tax Credit up to.

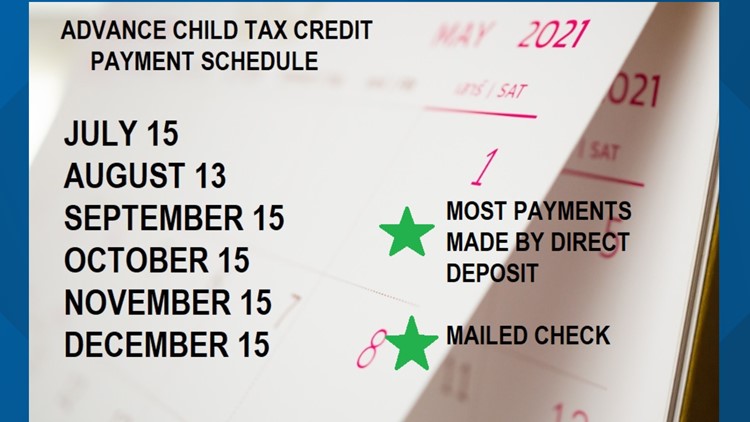

If you received advance payments of the Child Tax Credit you need to reconcile. Updated March 8 2022. Ad Easy Software To Help You Find All the Tax Deductions You Deserve.

Child Tax Credit 2021 When Will The September Payment Come Wbir Com

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Child Tax Credit 2021 What S Changed Multop Financial

Child Tax Credit Help Is Here Community Action Committee Of Cape Islands Inc

Claim Advance Child Tax Credit On 2021 Return Filing 11alive Com

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

What Is The Child Tax Credit Tax Policy Center

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

Child Tax Credit Changes Weigh The Benefits Vs Impact On Your Tax Liability Grf Cpas Advisors

What To Know About The New Monthly Child Tax Credit Payments

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Will You Have To Repay The Advanced Child Tax Credit Payments Wdtn Com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Advance Child Tax Credit Payments Begin July 15

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Woai

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit 2021 Here S Who Will Get Up To 1 800 Per Child Nj Com